75% Oz Starbucks closed this week.Bris,Mel& Syd still on.

-

61 out of 84 Oz Starbucks will brew coffe till this weekend.Only

Brisbane, Melbourne and Sydney shops continue biz from Aug.

What have happened in Oz Starbucks and Oz biz environment?

Will guys in Oz tell us more?

http://www.starbucks.com/aboutus/pressdesc.asp?id=883

http://www.smh.com.au/news/national/starbucks-axes-partners/2008/07/29/1217097227287.html

http://www.smh.com.au/news/national/starbucks-axes-partners/2008/07/29/1217097227287.html -

any rumors for SG shops?

-

I believe it is due to good spectulation from the owners as Australia has been holding off pretty well thus far in the oil crisis by having high interest rates. and is predicted to free-fall soon. Investors are thus withdrawing capital in Australia before their mony devalues to nothingness.

Said that Aussie will bottom in 2-3 years before it picks up again.

-

noisy, you continue to baffle me with your utter lack of intelligence to grasp almost anything.

starbucks is going thru' a bad patch right now and not only its aussie's operations are affected. the ones in north america is equally brutal.

let me anticipate your next question, `what about our lion(noisy) city? how come we do so well still?"

well, the only reason is starbucks in singapore is run by bonfood, which is not a direct operation from starbucks inc like the US or elsewhere, including australia. one will not know if starbucks is doing well here. bonfood could be taking its losses by the chin or they are indeed making money. if push comes to shove, bonfood may indeed close some of their outlets here in singapore. i was just at plaza singapura at lunch catching up with an old friend and the starbucks there is not filled to the brim like it usually is.

if you follow the starbucks story, you would know that it went on a growth rampage 2-3 years back where the ceo proclaim that it will open 2-3 stores every day around the world. it even took on traditional expresso joints in mediterranean europe, considered untouchables. perhaps arrogance has gotten in a way of starbucks management; which is why they are reeling now. i am not fond of writing at lengths here, so if you search sites like businessweek or the wall street journal sites, i am sure you will read about starbucks' business challenges now.

if you must whip australia, pls find something more meaningful to post. or at least do your homework first.

because almost everything you slimed on australia has boomeranged back in your face.

-

Good grief, noisy lion!

Are you so desperate to whack Australia that you must take it out on Starbucks?

-

Australian banking sector crumbles

ANZ Bank of Australia warned its annual profit could fall by as much as 25% and hiked its bad loan provisions,

ANZ, Australia's fourth-largest bank, said net earnings could fall by A$800-million ($783-million) after taking A$1.2-billion in provisions in the second half because of deteriorating credit conditions and a softening economy

Unlike National Australia Bank, ANZ's problems are mostly homegrown, caused by deterioration in the country's housing market -

-

Originally posted by O o O:

Australian banking sector crumbles

ANZ Bank of Australia warned its annual profit could fall by as much as 25% and hiked its bad loan provisions,

ANZ, Australia's fourth-largest bank, said net earnings could fall by A$800-million ($783-million) after taking A$1.2-billion in provisions in the second half because of deteriorating credit conditions and a softening economy

Unlike National Australia Bank, ANZ's problems are mostly homegrown, caused by deterioration in the country's housing market -

i have heard of this before recently, some predict a hard landing towards the end of this year but most frens there i spoke with said this is just a correction, nothing in the scale of what we saw in the states side.one reason for this is the crippling interest rate that is charge for housing loans and a streneous checks on affordability or repayment by home loaners is buffering the `fall'. the homes affordability index is rising in australia, in other words, aussies are less able to afford housing there due to various reasons. other factors include the rebuilding of housing in key cities like melbourne is does not equal to the numbers of (old) housing torn/making way for redevelopment. that buffered the dd/ss of housing from collapsing. some form of corrections is expected after almost 5 years of continous housing boom down under.

now, the question for you is, does singapore banking sector grew and grew each year? and with the economic meltdown that happened not too long ago, were our big 4 continue to post healthy growth and profits?

-

Originally posted by redDUST:

i have heard of this before recently, some predict a hard landing towards the end of this year but most frens there i spoke with said this is just a correction, nothing in the scale of what we saw in the states side.one reason for this is the crippling interest rate that is charge for housing loans and a streneous checks on affordability or repayment by home loaners is buffering the `fall'. the homes affordability index is rising in australia, in other words, aussies are less able to afford housing there due to various reasons. other factors include the rebuilding of housing in key cities like melbourne is does not equal to the numbers of (old) housing torn/making way for redevelopment. that buffered the dd/ss of housing from collapsing. some form of corrections is expected after almost 5 years of continous housing boom down under.

now, the question for you is, does singapore banking sector grew and grew each year? and with the economic meltdown that happened not too long ago, were our big 4 continue to post healthy growth and profits?

I believe the underlying reasons is very similar to USA and UK market, where majority of the Australians are spreading themselves too thin with hope that their lifestyle will be financed by their "ever appreciating" property investment. And I also believe that the growth in Australia over the past few years are mostly related to the mining industry and thats why property in perth are now one of the most expensive in Australia.

And now that the property prices is starting decline while interest rate remain high (due to inflation) most home owners will very soon be holding on to negative asset properties and fore closures will rise.

During the last Asia financial crisis, which center around SE Asia, several banks (OUB, Keppel Bank, Tat Lee Bank) in Singapore merged and that has given them the additional size and liquidity to go around the region to acquire crippliing foreign banks. Hence to answer you questions, the financial crisis didnt actually slow Singapore bank down, it actually gave them the opportunity to venture overseas.

-

im surprised that the LN, gazelle and others didnt even pose news about how amit nagpal wrote to the ST newspapers and demand for his rights to buy HDB flats directly, without serving NS or reservists. and behave so arrogantly in SG.. given the facts that PAP love FTs so much at the expense of singapore citieznes.

do focus on sg matter lah.

-

Originally posted by O o O:

I believe the underlying reasons is very similar to USA and UK market, where majority of the Australians are spreading themselves too thin with hope that their lifestyle will be financed by their "ever appreciating" property investment. And I also believe that the growth in Australia over the past few years are mostly related to the mining industry and thats why property in perth are now one of the most expensive in Australia.

And now that the property prices is starting decline while interest rate remain high (due to inflation) most home owners will very soon be holding on to negative asset properties and fore closures will rise.

During the last Asia financial crisis, which center around SE Asia, several banks (OUB, Keppel Bank, Tat Lee Bank) in Singapore merged and that has given them the additional size and liquidity to go around the region to acquire crippliing foreign banks. Hence to answer you questions, the financial crisis didnt actually slow Singapore bank down, it actually gave them the opportunity to venture overseas.

don't kid yourself, it is a matter of survival. otherwise some of these banks would have gone under.

buying into other ailing banks is more opportunistic. venturing overseas is one thing, crisis or no crisis. are they doing as well with those banks is quite another.

-

Originally posted by O o O:

I believe the underlying reasons is very similar to USA and UK market, where majority of the Australians are spreading themselves too thin with hope that their lifestyle will be financed by their "ever appreciating" property investment. And I also believe that the growth in Australia over the past few years are mostly related to the mining industry and thats why property in perth are now one of the most expensive in Australia.

And now that the property prices is starting decline while interest rate remain high (due to inflation) most home owners will very soon be holding on to negative asset properties and fore closures will rise.

During the last Asia financial crisis, which center around SE Asia, several banks (OUB, Keppel Bank, Tat Lee Bank) in Singapore merged and that has given them the additional size and liquidity to go around the region to acquire crippliing foreign banks. Hence to answer you questions, the financial crisis didnt actually slow Singapore bank down, it actually gave them the opportunity to venture overseas.

but i'm slowed down leh.

-

Originally posted by redDUST:

don't kid yourself, it is a matter of survival. otherwise some of these banks would have gone under.

buying into other ailing banks is more opportunistic. venturing overseas is one thing, crisis or no crisis. are they doing as well with those banks is quite another.

Please dont try to discount the work MAS has done to ensure the survival of Singapore banking system during the crisis, because many big US banks have failed while trying to stay afloat.

It is always easy to speak like an armchair critics after the dust has settled down, but without liquidity and financial muscle, how on earth is our local banks able to be opportunistic by venture overseas?

-

Originally posted by fudgester:

Good grief, noisy lion!

Are you so desperate to whack Australia that you must take it out on Starbucks?

Maybe to him/her Oz is the axis of evil and must be annihilated at all costs! -

Originally posted by O o O:

Please dont try to discount the work MAS has done to ensure the survival of Singapore banking system during the crisis, because many big US banks have failed while trying to stay afloat.

It is always easy to speak like an armchair critics after the dust has settled down, but without liquidity and financial muscle, how on earth is our local banks able to be opportunistic by venture overseas?

equally easy for an armchair apple polisher to speak after the fact....singapore's safety net culture comes in handy in times of crisis, if you take into a/c how many of the inner circle frens and relatives of the lees' are impacted by the downturn; are these `rescues' and perk ups not expected?

venturing overseas is a natural progression given the finite market in singapore. not just singapore is doing it. others in around the region is also doing it, in other industries like beverage, etc. think san miguel from the philippines, etc. maybank in malaysia is another banks extending overseas, also congromerate like ytl, genting berhad too are expanding their presence overseas thru' acquisitions.

you talk like as if only singapore is capable of doing so. next time, get out of your well once in a while and expand your horizon.

-

Originally posted by redDUST:

equally easy for an armchair apple polisher to speak after the fact....singapore's safety net culture comes in handy in times of crisis, if you take into a/c how many of the inner circle frens and relatives of the lees' are impacted by the downturn; are these `rescues' and perk ups not expected?

venturing overseas is a natural progression given the finite market in singapore. not just singapore is doing it. others in around the region is also doing it, in other industries like beverage, etc. think san miguel from the philippines, etc. maybank in malaysia is another banks extending overseas, also congromerate like ytl, genting berhad too are expanding their presence overseas thru' acquisitions.

you talk like as if only singapore is capable of doing so. next time, get out of your well once in a while and expand your horizon.

You have to remember that YOU have specifically asking me about the health of Singapore banks during the financial crisis. (see your own question) , so why are you talking about San Miguel, Malaysia banks etc?

Originally posted by redDUST:now, the question for you is, does singapore banking sector grew and grew each year? and with the economic meltdown that happened not too long ago, were our big 4 continue to post healthy growth and profits?

If you cant accept facts that contradict your believe, then I think you should stop asking questions and continue to live in your little fantasy.

-

Originally posted by O o O:

You have to remember that YOU have specifically asking me about the health of Singapore banks during the financial crisis. (see your own question) , so why are you talking about San Miguel, Malaysia banks etc?

If you cant accept facts that contradict your believe, then I think you should stop asking questions and continue to live in your little fantasy.

you dumb ass, i was commenting on your earlier post about banks in australia nearing a `meltdown' as you gleefully posted.you went on to rant about venturing overseas, etc. you mean only banks can venture overseas and only singapore in this region can venture overseas?

if you cannot even add one and one together, change your nick (again)

-

Originally posted by redDUST:

you dumb ass, i was commenting on your earlier post about banks in australia nearing a `meltdown' as you gleefully posted.you went on to rant about venturing overseas, etc. you mean only banks can venture overseas and only singapore in this region can venture overseas?

if you cannot even add one and one together, change your nick (again)

1) This is your questionOriginally posted by redDUST:now, the question for you is, does singapore banking sector grew and grew each year? and with the economic meltdown that happened not too long ago, were our big 4 continue to post healthy growth and profits?

2) This is my reply to you

During the last Asia financial crisis, which center around SE Asia, several banks (OUB, Keppel Bank, Tat Lee Bank) in Singapore merged and that has given them the additional size and liquidity to go around the region to acquire crippliing foreign banks. Hence to answer you questions, the financial crisis didnt actually slow Singapore bank down, it actually gave them the opportunity to venture overseas.

3) This is your comment

Originally posted by redDUST:don't kid yourself, it is a matter of survival. otherwise some of these banks would have gone under.

buying into other ailing banks is more opportunistic. venturing overseas is one thing, crisis or no crisis. are they doing as well with those banks is quite another.

4) This is my reply

Please dont try to discount the work MAS has done to ensure the survival of Singapore banking system during the crisis, because many big US banks have failed while trying to stay afloat.

It is always easy to speak like an armchair critics after the dust has settled down, but without liquidity and financial muscle, how on earth is our local banks able to be opportunistic by venture overseas?

5) This is your comment

Originally posted by redDUST:

venturing overseas is a natural progression given the finite market in singapore. not just singapore is doing it. others in around the region is also doing it, in other industries like beverage, etc. think san miguel from the philippines, etc. maybank in malaysia is another banks extending overseas, also congromerate like ytl, genting berhad too are expanding their presence overseas thru' acquisitions.6) This is my reply

You have to remember that YOU have specifically asking me about the health of Singapore banks during the financial crisis. (see your own question) , so why are you talking about San Miguel, Malaysia banks etc?

For someone who have grew up living in his little fantasy, it is common that he will think he is the smartest one.

-

Originally posted by O o O:

1) This is your question2) This is my reply to you

During the last Asia financial crisis, which center around SE Asia, several banks (OUB, Keppel Bank, Tat Lee Bank) in Singapore merged and that has given them the additional size and liquidity to go around the region to acquire crippliing foreign banks. Hence to answer you questions, the financial crisis didnt actually slow Singapore bank down, it actually gave them the opportunity to venture overseas.

3) This is your comment

4) This is my reply

Please dont try to discount the work MAS has done to ensure the survival of Singapore banking system during the crisis, because many big US banks have failed while trying to stay afloat.

It is always easy to speak like an armchair critics after the dust has settled down, but without liquidity and financial muscle, how on earth is our local banks able to be opportunistic by venture overseas?

5) This is your comment

6) This is my reply

You have to remember that YOU have specifically asking me about the health of Singapore banks during the financial crisis. (see your own question) , so why are you talking about San Miguel, Malaysia banks etc?

For someone who have grew up living in his little fantasy, it is common that he will think he is the smartest one.

i don't need to dumb down to your level of understanding so you have the benefit of the doubt.

you brought out 2 points, banking and venturing overseas. i am merely explaining to you that banking in singapore isn't going great guns either, otherwise they would not have merged. as to venturing overseas, it has little to do with financial crisis or not, it happens all the time, and i quoted other examples to illustrate that the point.

for all you want, you can stick to your semantics and walk your narrow plank in pushing forth your point.

additionally, i have never categorically stated that i am the smartest one, show proof or go poof. your concluding sentence is a classic when you couldn't explain yourself well; hence resorting to such nitty gritties. well, we know whose brain is fill with molecular dye cells.

-

Originally posted by lionnoisy:

any rumors for SG shops?

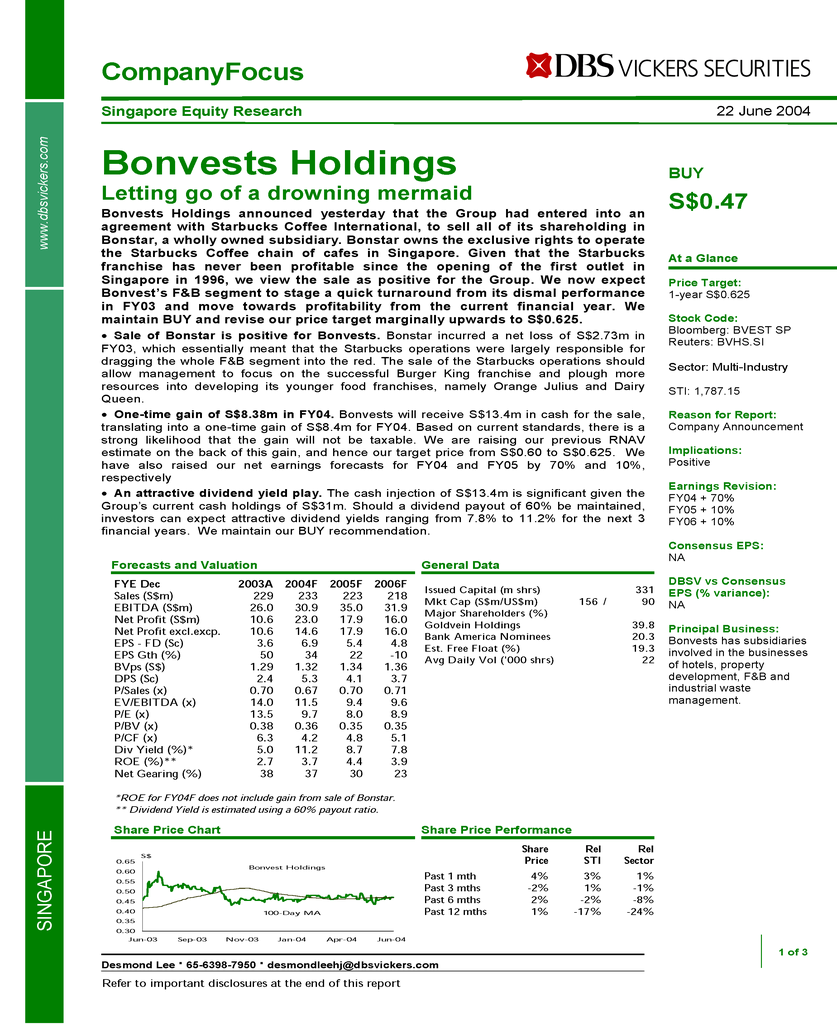

Singapore's Starbucks shops already sold back to Starbucks International afew years back, after Bonstar failed to make profits from their franchising rights in Singapore.Major pwnage again.

http://www.dbs.com/researchasset/weeklyhighlights/2004/21june/bvest220604cf.pdf

-

Australians have more taste la....

-

Originally posted by redDUST:

i don't need to dumb down to your level of understanding so you have the benefit of the doubt.

you brought out 2 points, banking and venturing overseas. i am merely explaining to you that banking in singapore isn't going great guns either, otherwise they would not have merged. as to venturing overseas, it has little to do with financial crisis or not, it happens all the time, and i quoted other examples to illustrate that the point.

for all you want, you can stick to your semantics and walk your narrow plank in pushing forth your point.

additionally, i have never categorically stated that i am the smartest one, show proof or go poof. your concluding sentence is a classic when you couldn't explain yourself well; hence resorting to such nitty gritties. well, we know whose brain is fill with molecular dye cells.

Please dont try to talk yourself up by calling other names because this sort of behavior are always linked to sore losers who are running out of facts to support his argument.Our discussion started when I posted a link to ANZ Bank article, and you started questioning me about Singapore banks during the financial crisis. Hence our conversation should be talking about financial, Singapore and Aussie banks.

Hence I am just puzzled why you suddenly started talking about San Miguel, Malaysia Maybank and telling us that M&A happens all the time. Who are you trying to impress? Yourself who is living in the well?

-

Originally posted by O o O:

Please dont try to talk yourself up by calling other names because this sort of behavior are always linked to sore losers who are running out of facts to support his argument.Our discussion started when I posted a link to ANZ Bank article, and you started questioning me about Singapore banks during the financial crisis. Hence our conversation should be talking about financial, Singapore and Aussie banks.

Hence I am just puzzled why you suddenly started talking about San Miguel, Malaysia Maybank and telling us that M&A happens all the time. Who are you trying to impress? Yourself who is living in the well?

like i said, you are entitled to walk your narrow plank. when you mentioned "how on earth is our local banks able to be opportunistic by venture overseas?" you yourself expanded the topic of discussion. so, you pull back your OB line just because your bootlicking claim about your allmighty government is only capable of doing the right thing is disputed?

and btw, what facts have you posted on this thread?

-

Originally posted by redDUST:

like i said, you are entitled to walk your narrow plank. when you mentioned "how on earth is our local banks able to be opportunistic by venture overseas?" you yourself expanded the topic of discussion. so, you pull back your OB line just because your bootlicking claim about your allmighty government is only capable of doing the right thing is disputed?

and btw, what facts have you posted on this thread?

Nobody is stopping you from challenging what I wrote. If you have reasons to believe what I said is not true, why dont you just cut the chase and challenge me, instead of glorifying yourself, beating round the bush and sprouting all the stupid accusation.

When you ask me the below question, (i repeat, it is a question from YOU to me asking about Singapore banks during the finacial crisis) how on earth am I supposed to know that I cant talk about Singapore banks going on a shopping spree during the Asian financial crisis. which btw I am inviting you to challenge me if you think that is not FACTS.

And please tell me, WTF does San Miguel and Maybank have got to do with Singapore banks?

now, the question for you is, does singapore banking sector grew and grew each year? and with the economic meltdown that happened not too long ago, were our big 4 continue to post healthy growth and profits?

-

any updates on SQ006 and MI185?

heard that Mugabe, Burma Tan Sui fly into SG for medical. and ousted Nepal King is now in SG for good.

look like it has become a safe haven for druglords, dictators and dodgy rich people. oh ya, i forgot, the head family of SG is such... birds of the same feathers flock together?

-

Originally posted by O o O:

Nobody is stopping you from challenging what I wrote. If you have reasons to believe what I said is not true, why dont you just cut the chase and challenge me, instead of glorifying yourself, beating round the bush and sprouting all the stupid accusation.

When you ask me the below question, (i repeat, it is a question from YOU to me asking about Singapore banks during the finacial crisis) how on earth am I supposed to know that I cant talk about Singapore banks going on a shopping spree during the Asian financial crisis. which btw I am inviting you to challenge me if you think that is not FACTS.

And please tell me, WTF does San Miguel and Maybank have got to do with Singapore banks?

....and tell me, when you started to deviate into foreign ventures, does only restrict to banks?

and post your facts on singapore banks that merged/consolidated is not due to their own untenable positions but sound MAS policies as you inferred and i will tell you why you are talking thru' your arse (again)

post the facts or otherwise, you should move on and spin another glory, glory singapore tales of yours.